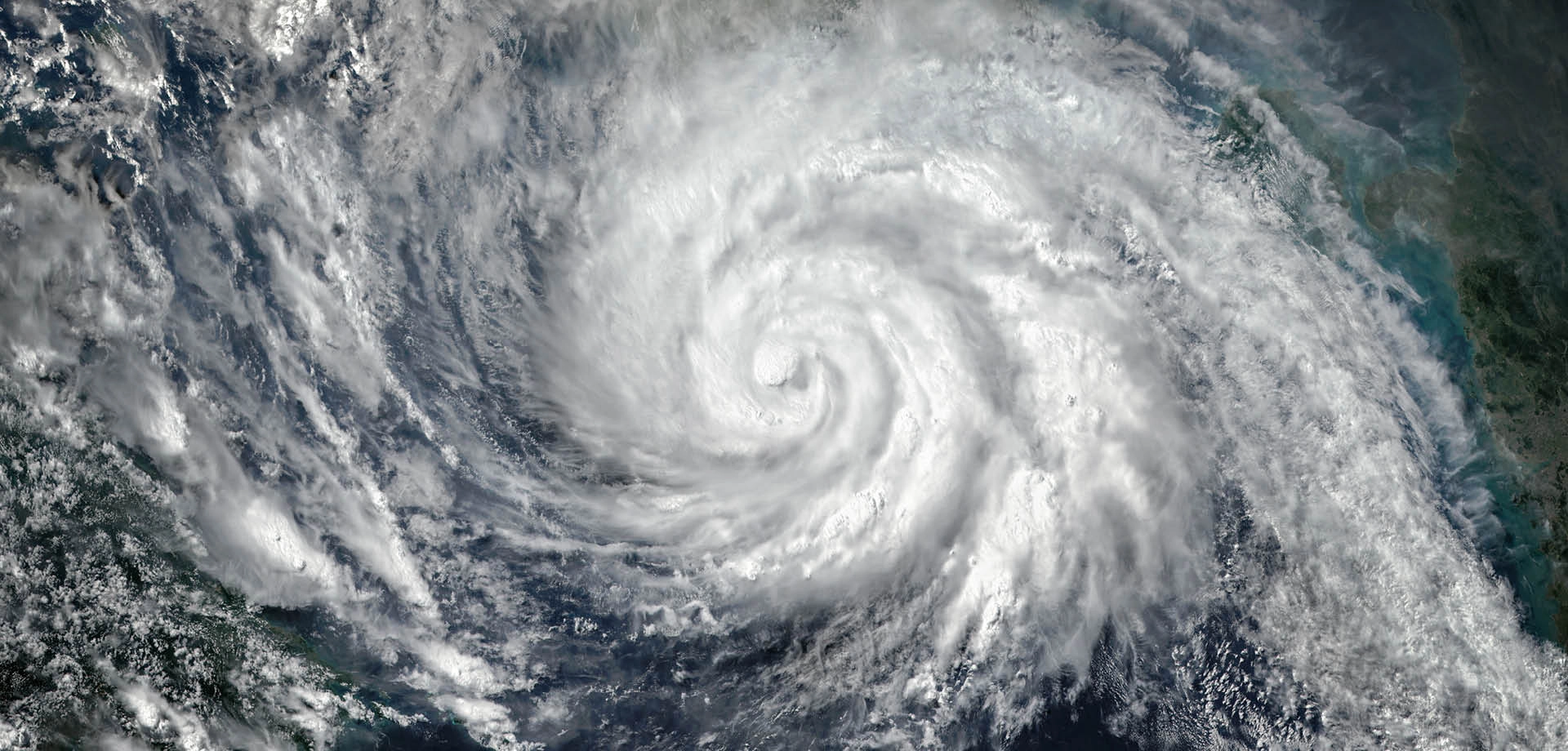

After a large storm, companies and other large organizations often face significant property damage, power outages, physical access issues, and resulting business interruption losses.

A key step in recovering from a hurricane involves accessing insurance. Many insureds have questions such as: Are we covered? How do we prepare our claim? What if we suffered because our customers or suppliers were impacted? Are governmental funds available to aid our recovery? These and other issues are crucial to accelerating and maximizing the recovery process, and Bracewell’s insurance recovery team is here to help, starting with this summary of key issues:

1. Protect People and Property

Protecting your people is the first priority. Protecting property is next, and any emergency measures should be documented.

2. Gather All Insurance Policies

Businesses must carefully review all potentially applicable insurance policies. That starts with gathering them. Property insurance is the most obvious source of coverage, but do not overlook other policies, such as auto or pollution. Besides your company’s own policies, also look for coverage from other sources, such as what is required by contracts with suppliers.

3. Assess All Potential Coverages

What coverages apply? What are the limits, deductibles and waiting periods? What conditions apply? If a loss triggers multiple coverages, does the policy allow stacking? These and other questions must be answered before you assert coverage positions. The policy is the starting point, but it is also crucial to know how courts interpret that language.

Commercial property policies usually cover physical losses and resulting economic impacts. Flood is often covered, but sometimes with sublimits or through an ensuing loss provision. Coverage may apply even if the insured’s own property was not physically damaged. For example, your financial losses incurred due to damage to suppliers or customers may be covered as “contingent business interruption.” Similarly, disruption of power and other utilities may trigger service interruption coverage. Curfews, orders, and physical obstructions may trigger civil authority or ingress/egress coverage.

4. Notify Insurers

Even if you have not yet identified all of your losses, notify any insurance company you might seek coverage from. Do not assume there is no coverage. Verify it. And a notice is just a notice — it simply tells your insurance company that you might have a claim. It does not need to be particularly detailed at first, so there is no reason to delay. The policies will tell you what is required — just follow the instructions, and remember they vary in terms of what is needed, along with how and when it is to be communicated. Some carriers require an email, while others use a web portal. Certain coverages, such as pollution, have very short timelines, sometimes only hours or days.

5. Document and Mitigate Losses

Carefully documenting losses, especially before you undertake major restoration efforts, is important. Take notes. And pictures. If you’re using a phone, transfer the pictures to a more secure device. Document actions taken and why. Track expenses for professional fees, mitigation and clean-up costs, using separate accounts. Save invoices and receipts.

You must make reasonable efforts to protect property from further losses, including mitigating additional damage. Because this is required, mitigation expenses are usually covered and as long as your efforts are reasonable, carriers are usually reluctant to second-guess an insured.

6. Consider Financial Impacts

Did revenues drop? Did expenses go up? Were sales lost? Business interruption and related coverages reimburse insureds for financial impacts like these.

7. Engage Experts

Insurance carriers use teams to deal with claims, usually a mix of adjusters, coverage lawyers, accountants, and engineers. Insureds should have that same team so they match up with the carrier, especially when at least some of these fees, such as those of accountants, are typically covered.

Having experienced coverage counsel that represents policyholders rather than carriers can guide you through the process, and also help protect communications as privileged. Counsel may work in the background or take a front-facing role as needed. Insurers typically do the same thing. Cooperate with the insurance company’s team, but don’t forget that they work for the insurer, not you. If you need experts, don’t borrow the carrier’s. Hire your own.

8. Follow the Policy to Preserve the Claim

Policies sometimes require the insured to submit a proof of loss or take other actions within a set period of time. Insurers are usually amenable to modifying these if requested, but make sure that any agreements are properly memorialized in writing.

9. Control Your Claim

It is your claim. Try to avoid having the insurance company categorize or characterize it before you have had an opportunity to do that yourself. If that happens anyway, then remember that insurance claims are an iterative process, and you can make any necessary corrections.

10. Communicate

Keep an open dialogue with your team and the carrier’s representatives. Stay professional and civil. Ask for, and provide, clarifications when needed.

11. Property Has Value

When it comes to older equipment, or equipment in poor condition, carriers sometimes try to claim scrap value is all they owe. But check your policy — some policies provide replacement cost coverage, and that is a valuable right even if it results in betterment. Speaking of upgrades, look for code upgrade coverage, which often applies as building standards are held to higher scrutiny following hurricane activity.

12. Relationships Have Value Too

Your relationships matter. Your broker’s team can also help. Even the relationships between coverage counsel or the accounting specialists and their counterparts on the insurer’s side can make a difference. These are important and should be drawn upon as needed.

13. Government Funds Might Be Available for Non-Profits Providing Essential Services

FEMA and other government-based programs are potentially available for non-profit organizations that provide essential services, such as healthcare providers, educational institutions, emergency services, utilities, libraries, museums, zoos, community centers, airports and other services that, in their absence, the government would be expected to provide. The process can be daunting, and strict time limits apply (though they are usually extended). A successful applicant can see FEMA reimburse most of the eligible costs for emergency protective measures and permanent restoration costs. FEMA does not, however, pay business interruption losses and aid recipients must reimburse FEMA for any benefits that are duplicated by insurance. Knowing the Stafford Act and its regulations is key to obtaining and maintaining a FEMA recovery.

14. Seek Resolution — It Will Better Position You Whether Your Claim Settles or Not

Claims that are well thought out and well documented usually yield better outcomes than ones that are not. Ask for advances as losses are submitted. After doing that, work towards resolving the claim. If the claim is promptly paid, then you are on your way to recovery. If not, then you may be well positioned to pursue a bad faith claim if the insurer acted unreasonably.

How Bracewell Can Help

Our lawyers have helped clients recover billions of dollars from major disasters, including virtually every hurricane and named storm in the last 20 years. We advise policyholders seeking coverage under every kind of commercial insurance policy, assisting them in getting the most out of their insurance coverage by negotiating and litigating as needed to provide the most advantageous results. With a proven track record of doing this against major insurers across the globe, we are strong advocates for our clients while also being mindful of commercial concerns that may influence how we approach a given matter.

Bracewell’s team is recognized as a go‐to resource by leading international insurance brokers and consultants who refer their clients when coverage issues arise. It is led by Vince Morgan, a past Chair of the Insurance Law Section of the State Bar of Texas and the author of the chapters on the Claim Process and Business Interruption for the only legal treatise specifically focused on insurance coverage for catastrophe losses.

A version of this update was published by The Texas Lawbook on July 12, 2024.