Welcome to the latest issue of Bracewell’s FINRA Facts and Trends, a monthly newsletter devoted to condensing and digesting recent FINRA developments in the areas of enforcement, regulation and dispute resolution. This month, we report on FINRA’s first Regulation BI enforcement action, reveal rare praise from the investors’ bar for FINRA’s arbitration procedures, and outline FINRA’s revised sanctions guidelines. Read about these issues, along with notable enforcement actions and arbitration decisions, below.

FINRA Brings First Reg BI Enforcement Action

It was a matter of when, not if. Now, shortly after the SEC filed its first enforcement action alleging violations of Regulation Best Interest (“Reg BI”), FINRA has followed suit. In its first disciplinary action under Reg BI, FINRA has fined a broker $5,000 and issued a six-month suspension arising from allegations that the broker engaged in excessive trading that resulted in outsized commissions to the broker.

Charles Malico was charged with recommending a series of transactions in his client’s account that were “excessive in light of the customer’s documented investment profile and was therefore not in that customer’s best interest.” According to FINRA, the broker willfully violated the Best Interest Obligation under Rule 15l-1 of the Securities Exchange Act of 1934 and violated FINRA Rule 2010.

As set forth in the AWC, Malico recommend that his client, a 63-year-old with an annual income of $100,000 and a liquid net worth of $50,000, make more than 350 trades in his account from July 2020 through November 2021. “Malico frequently recommended that Customer A buy and then sell a security, only to repurchase the same security weeks or even days later,” FINRA stated. The excessive trading resulted in more than $54,000 in commissions and other trading costs. Over that same time period, the client’s average account balance was less than $30,000. The client lost more than $17,500 during the relevant time period, according to FINRA.

Interestingly, the AWC made a point of noting that “[n]o single test defines when trading is excessive, but factors such as turnover rate, the cost-to-equity ratio, and the use of in-and-out trading in a customer’s account are relevant to determining whether a member firm or associated person has excessively traded a customer’s account in violation of Reg BI.” According to FINRA, a turnover rate of six, or a cost-to-equity ratio above 20%, generally indicates the occurrence of excessive trading. Here, Malico’s recommendations resulted in an annualized cost-to-equity ratio of 158%, meaning that the client’s portfolio would have had to appreciate by 158% just to recover the trading expenses and break even, making “it virtually impossible for Customer A to realize a profit.”

As is often the case, FINRA became aware of the broker’s conduct following a review of a customer-initiated arbitration that alleged negligence, breach of fiduciary duty, and negligent supervision. We expect that FINRA will continue to closely inspect recently-filed customer complaints and arbitrations as it pursues additional Reg BI enforcement actions.

FINRA Issues Revised Sanctions Guidelines

On September 29, 2022, FINRA released Regulatory Notice 22-20, alerting member firms to significant changes to its Sanctions Guidelines (the “Guidelines”). These Guidelines are used by FINRA’s Office of Hearing Officers, the National Adjudicatory Council and the Department of Enforcement in contested disciplinary actions and negotiated settlements.

Here is a summary of the key changes:

- Two Subsets of Ranges. For the first time, FINRA has introduced one subset of Guidelines for individuals, and one subset for member firms.

- Separate Fine Ranges for Small and Mid-size or Large Firms. Monetary sanctions will now bear some relationship to the size of the member firm.

- Elimination of Upper Limit on the Fine Range for Mid-Size or Large Firms for Certain Rules Violations. For the “most serious violations that FINRA pursues” and to “reflect the settlement amounts that FINRA frequently seeks for these types of violations,” the Guidelines have removed the upper limit of the highest recommended fine for the following violations:

- Sales of Unregistered Securities;

- Failure to Respond or Failure to Respond Truthfully to Requests Made Pursuant to FINRA Rule 8210;

- Best Execution;

- Marking the Open or Marking the Close;

- Churning, Excessive Trading, or Switching;

- Fraud, Misrepresentations or Material Omissions of Fact;

- Pricing – Excessive Markups/Markdowns and Excessive Commissions;

- Research Analysts and Research Reports; and

- Supervision – Systemic Supervisory Failures.

- Addition of New AML Guidelines. FINRA has removed the upper limit of the highest recommended fine for mid and large-size firms that fail to reasonably monitor to report suspicious transactions, and also created six specific AML Guidelines, three for individuals and three for firms.

- Quality of Markets. The Guidelines change the fine ranges for Quality of Market rule violations and introduce a single fine range for Quality of Market rule violations.

- $5,000 Minimum Fine. The Guidelines establish a minimum fine of $5,000 for all fines, regardless of firm size. This change addresses the fact that FINRA “does not routinely settle disciplinary matters with firms, other than minor rule violations, for less than $5,000.”

- Non-Monetary Penalties. The Guidelines create additional non-monetary sanctions for individuals and firms that engage in repeated violations of FINRA Rules or for serious misconduct. These non-monetary sanctions include: suspending or barring a respondent firm from engaging in a specific line of business; requiring a firm to implement heightened scrutiny on individuals or departments within the firm; and requiring independent consultants to design and implement procedures for improved compliance.

The new Guidelines also deleted previous guidelines that FINRA determined had either occurred too infrequently or were incorporated elsewhere.

The FINRA press release announcing the revised Guidelines is available here. The new Guidelines are effective immediately and we encourage all member firms to review them to determine how these revised Guidelines might impact current and future matters.

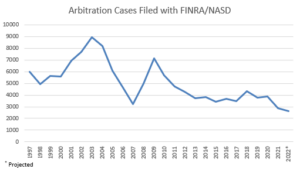

Arbitration Filings Continue Downward Trend

Only 1,955 arbitration cases were filed with FINRA Dispute Resolution Services (DRS) through September, according to its third quarter report. If this rate continues through year-end, 2022 will conclude with approximately 2,607 new arbitration filings, the fewest since at least 1997.

These rates are consistent with the common assumption that arbitration case filings are countercyclical. Put simply, since the market has generally been strong over the past few years, customers aren’t looking to pick fights. Whether recent market volatility will result in a rebound in arbitration filings remains to be seen—indeed, if you squint, third quarter filings have demonstrated a very slight uptick compared to the first two quarters of 2022.

One area that has not seen a slowdown, however, are filings of Regulation BI arbitration claims by customers against their brokers. As we reported earlier this year, Reg BI claims had already cracked the top 15 controversy types by May 2022, despite the regulation’s adoption just two years earlier. According to the September report, the 130 Reg BI claims through September have moved the category up to 12th place.

We will report on year-end statistics in early 2023.

PIABA Praises FINRA Dispute Resolution Services

Back in August, the SEC issued a notice soliciting comments on its draft five-year Strategic Plan. One of the more notable comments came from PIABA, the investor-side bar association, which objects to the Strategic Plan’s failure to address the rise of mandatory pre-dispute arbitration agreements employed by SEC- and state-registered Registered Investment Advisers (RIAs)—advisers who are not governed by the FINRA rules applicable to brokers.

Unsurprisingly, PIABA opposes the use of these arbitration agreements, detailing a series of objections ranging from excessive forum fees, to inconvenient venue selection clauses, to a lack of transparency regarding the filing or results of arbitration cases. PIABA calls for the SEC to “make efforts to control RIAs’ use of pre-dispute clauses and require, among other things, standardized pre-dispute clauses, shifting of the majority of arbitration fees to the RIAs using such clauses, increased transparency of the scope and implications of the dispute process, as well as the mandatory disclosure of information regarding a RIA’s dispute history so the SEC and investing public may be better informed.”

Interestingly, however, PIABA holds up FINRA arbitration as, if not the gold standard, then at least a “more accessible forum with superior investor protections.” The comment letter praises FINRA’s Dispute Resolution arbitration program for, among other things, requiring member firms to prominently disclose the terms of arbitration clauses, tracking information about investor complaints, and subsidizing the bulk of forum fees.

PIABA concludes its letter by asking the SEC to require RIAs to adopt standardized and transparent pre-dispute clauses providing protections at least as strong as those provided by FINRA.

Notable Enforcement Matters and Disciplinary Actions

- “Naked” Short Selling and Regulation SHO. A multinational brokerage firm was sanctioned $2.5 million for violations of Rule 204 of Regulation SHO and FINRA Rule 2010. The AWC detailing FINRA’s findings on this matter is available here. Rule 204(a) of Regulation SHO is designed to address persistent “failures to deliver” (FTDs) that result from “naked” short sales—i.e., short sales in equity securities that an investor does not own. The Rule requires broker-dealers to “close out” FTDs resulting from short sales by borrowing or purchasing securities of like kind and quantity by the day following the transaction. When an FTD is not closed out, Rule 204(b) of Regulation SHO prohibits the broker-dealer from engaging in further short sales in that security until the broker-dealer borrows the underlying security—known as the “penalty box” provision.The brokerage firm in this case sought to comply with Rule 204 by implementing revocable orders and limit orders to close out open FTDs. But between 2009 and 2018, the firm canceled 124 of these revocable orders, and the limit orders failed to meet the full size of the buy-in obligation in thousands of additional instances. As a result, FINRA found that the firm failed to take effective close-out action, in violation of Rule 204(a), on approximately 5,300 occasions.

As a result of these failures to close out, each of the securities also should have been subject to the “penalty box” provision, and the firm should have restricted additional short sales in the securities. Because it did not, the firm was found to have routed or executed, between 2016 and 2018, at least 71,000 short sales in securities that should have been restricted because of open FTDs, resulting in violations of Rule 204(b).

Finally, FINRA found that the brokerage firm failed to establish and maintain a supervisory system reasonably designed to achieve compliance with Rule 204, in violation of FINRA and NASD Rules 3110 and 3010 respectively.

- The Best Execution Rule. A securities broker-dealer received a censure and a $2 million fine resulting from alleged failures to meet its best execution obligations under FINRA Rules 5310 and 5310.09. The AWC detailing FINRA’s findings on this matter is available here. FINRA’s “best execution” rule, broadly speaking, requires broker-dealers to seek the most favorable terms for their customers’ orders that are reasonably available under the circumstances. The violations in this case resulted from the broker-dealer’s use of an Alternative Trading System (ATS), through which the firm routed 74 percent of its customers’ orders beginning in February 2019. FINRA found that the firm failed to consider whether alternate routing arrangements could have provided price improvement opportunities and better speed of execution, as compared to routing the orders through the firm’s ATS.As a result, FINRA found that the firm had violated FINRA Rules 5310, 5310.09(a) and (b), and 2010. FINRA also found that the firm did not implement a supervisory system that was reasonably designed to achieve compliance with the results, resulting in further violations of FINRA Rules 3110(a) and (b), and 2010.

- Disqualification. In a matter of first impression, FINRA’s Office of Hearing Officers ruled that entry of an ex parte temporary restraining order against an associated person triggers statutory disqualification under the Exchange Act. The panel’s decision is available here. In May 2021, FINRA Enforcement filed a complaint against broker-dealer NYPPEX LLC, its former CEO Laurence Allen, and its current CEO Michael Schunk, alleging misconduct that followed the December 2018 entry of an ex parte TRO against Allen by a New York state court. The TRO had preliminarily enjoined Allen from, among other things, engaging in securities fraud and converting investor funds.FINRA Enforcement alleged that, following entry of the TRO, Schunk and NYPPEX remained associated with Allen in violation of FINRA’s by-laws, which prohibit a member firm from associating with a person subject to statutory disqualification under the Exchange Act. A person is subject to statutory disqualification if, among other things, that person “is permanently or temporarily enjoined by order, judgment, or decree of any court of competent jurisdiction from . . . engaging in or continuing any conduct or practice in connection with any such activity, or in connection with the purchase or sale of any security.”

OHO rejected the Respondents’ argument that the ex parte nature of the TRO failed to trigger statutory disqualification. It reasoned that nothing in the language of the Exchange Act required notice and opportunity to be heard before an event like a TRO is disqualifying. The OHO similarly rejected Respondents’ advice-of-counsel defense because “scienter is not an element of the violation.”

Since NYPPEX remained associated with Allen after his disqualification—along with engaging in other misconduct—it was expelled from FINRA membership. Allen was barred from the securities industry; and Schunk was fined $120,000, suspended for three-and-a-half years, and barred from acting in any principal or supervisory capacity

Notable FINRA Arbitration Awards

- Options trading. We have reported in several issues of this newsletter on a series of customer arbitration proceedings related to investments in a securities broker-dealer’s managed account options trading strategy. One additional award has been issued since we last reported, resulting in an unqualified victory for the broker-dealer.

- FINRA Case No. 20-01504 – Following a ten-day hearing related to an individual Claimant’s investments in the options trading strategy, a three-arbitrator panel dismissed claims seeking up to $1 million in rescissory damages in their entirety, and also recommended expungement of the claims from an associated person’s CRD records. In recommending expungement, the panel specifically found that Claimant had failed to establish “any alleged misrepresentation or material omission to Claimant” regarding the options strategy, and also failed to establish that the strategy was unsuitable in light of the “Claimant’s trading history” and other relevant aspects of the Claimant’s investment profile.

- Industry Dispute

- FINRA Case No. 20-02547 – In an industry dispute between an investment management firm, as Claimant, and a FINRA broker-dealer, as Respondent, the Claimant sought more than $6 million in damages related to Respondent’s alleged failure to execute trades in Claimant’s account, resulting in alleged losses. Respondent asserted its own counterclaims for account stated, seeking $1.375 million related to Claimant’s alleged failure to repay an unsecured deficit pursuant to two client agreements. A three-arbitrator panel conducted a five-day hearing in Boca Raton, Florida, and issued an award denying Claimant’s claims in their entirety, and finding in favor of the Respondent broker-dealer on its claims. The panel awarded the full $1.375 million in compensatory damages on the counterclaims.

- Real Estate Investment Trusts (REITs). We have reported previously on arbitration awards related to investments in REITs, which have generally presented a mixed bag in terms of results. An award issued earlier this month resulted in the imposition of a substantial damages award against the Respondent.

- FINRA Case No. 21-02081 – The Statement of Claim in this arbitration alleged that the Respondent brokerage firm recommended unsuitable investments in at least four REITs, as well as certain additional private placement investments, in Claimant’s IRA account. The three-arbitrator panel issued an award granting compensatory damages and rescission: Claimant was ordered to assign the relevant investments to the brokerage firm, while the firm was found liable for more than $300,000 in damages to the Claimant, as well as an additional $100,000 in punitive damages.