TIFIA – The Impact of the Infra Act

For the last couple of decades, many US greenfield transportation projects have benefited from “TIFIA” financing. The Transportation Infrastructure Finance and Innovation Act of 1998 (“TIFIA” or the “Program”) created a credit program to facilitate the financing of large transportation projects, including roads, bridges and rail, among others[1]. TIFIA can provide credit assistance for the design and construction and, when applicable, the operation and maintenance, of eligible projects in the form of direct loans, loan guarantees and standby letters of credit. In practice, to our knowledge, most credit assistance provided to date has taken the form of subordinated direct loans. TIFIA was expanded under the comprehensive “Bipartisan Infrastructure Law” passed by Congress last fall after months of negotiations as the Infrastructure Investment and Jobs Act of December 2021 (the “IIJA”), which President Biden signed into law on November 15, 2021. In what follows, we will provide a general recap on the Program and explain how the IIJA will serve to grow the reach and availability of TIFIA funds for eligible US transportation projects.

TIFIA is implemented by the Secretary of Transportation and administered on their behalf by the Build America Bureau (the “Bureau”), an agency created in 2016 as a single point of contact for infrastructure financing[2]. The total amount of funds available for the Program in a particular year is determined by law, and there are limits on the percentage of the total available funds that can be deployed, depending on the type of eligible project[3]. Eligible transportation projects include the design and construction or installation of highways and bridges, intelligent transportation systems, intermodal connectors, transit vehicles and facilities, intercity buses and facilities and rural infrastructure projects that exceed a minimum size (for instance $10 million for local or rural projects, or $50 million for road and transit projects).

For each eligible project, TIFIA senior secured loan assistance is capped generally at 49% of eligible costs and at 33% for lines of credit. Project sponsors (typically, the department of transportation of the state, or another local authority or agency procuring the project) must file an application with the Bureau, providing general information on the project that demonstrates that the project will meet the Program’s eligibility requirements and comply with the necessary risk assessments; if the Bureau’s creditworthiness review is favorable, it will then execute a Letter of Intent with the relevant sponsor.

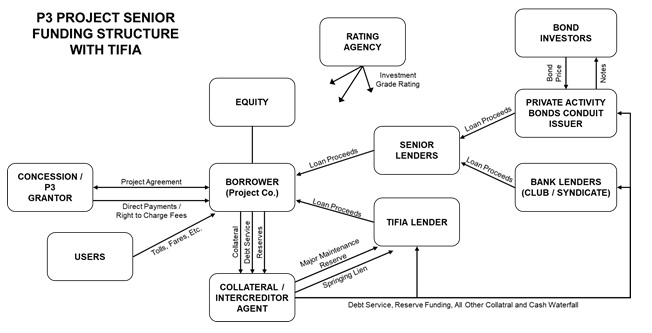

TIFIA loans are, by definition, project financings that must have a dedicated repayment source. In practice this source can be a periodic payment from the public authority that owns the asset, another dedicated third-party funding source, or user fees paid by customers (tolls, rail fares, user fees, tariffs) or a combination of the same. The Program was designed expressly to leverage federal funding by fostering partnerships that attract other public funds and private investments. In fact, often TIFIA funds are deployed in projects procured as a public-private partnership (“PPP” or “P3”) using different procurement methods, from the more basic (design-build, or design-build-finance) to the more complex (design, build, finance, operate and maintain, or “DBFOM”). Thus, typically, borrowers are private entities holding concession-type rights or public authorities that have a contractual or statutory right to the revenue, although governmental authorities can also borrow directly through from the Program if they can pledge a specific third-party revenue stream (for instance tobacco settlement funds). Consistent with this, TIFIA assistance is expressly contemplated to coexist with private sources of project funds (equity, senior bank loans and/or taxable or tax-exempt bond financing - including “private activity bonds”), as well as public funding such as direct grants.

TIFIA direct loans are provided on favorable terms; principally: first, by charging low interest rates (typically federal cost of funds plus a reasonable spread); and second, by accepting to be expressly subordinated to the senior debt (although such subordination is expressly contemplated to disappear if the borrower is involved in a bankruptcy event)[4]. TIFIA financings thus require intercreditor provisions designated to protect the TIFIA lender.

Importantly, TIFIA financing requires eligible projects to have an investment rating supported by one or two ratings (depending on the size of the project) from reputable agencies. In addition, a TIFIA secured loan will be subject to the completion of an environmental impact statement or similar analysis required under the National Environmental Policy Act of 1969 (“NEPA”).

Eligible Project Costs

The term eligible project costs means amounts substantially all of which are paid by, or for the account of, an obligor in connection with a project, including the cost of--

- Development phase activities, including planning, feasibility analysis, revenue forecasting, environmental review, permitting, preliminary engineering and design work, and other preconstruction activities;

- Construction, reconstruction, rehabilitation, replacement, and acquisition of real property (including land relating to the project and improvements to land), environmental mitigation, construction contingencies, and acquisition of equipment;

- Capitalized interest necessary to meet market requirements, reasonably required reserve funds, capital issuance expenses, and other carrying costs during construction; and

- Capitalizing a rural projects fund.

The following chart depicts a typical funding structure for a P3 project supported by TIFIA:

The $1 trillion IIJA is designed to facilitate the refurbishment, expansion and modernization of US transportation, water, broadband and energy infrastructure. One of the express policy goals of the IIJA is to enable the leveraging of federal funds to promote private investment. The IIJA does in part by expanding the kinds of projects eligible for TIFIA funding (although admittedly not as broadly as many in the industry had expected) and introducing other changes to make the Program more agile.

New eligible projects

First, the IIJA expanded TIFIA eligible projects to include three new categories of projects[5]:

- Transit-Oriented Transportation Projects: These refer to a project to improve or construct public infrastructure that either: is located within walking distance from and accessible to a transit, passenger rail, intercity bus, or intermodal facility, including a transportation, public utility or joint development capital project where future occupants of the financed facilities agree to pay a fair share of the costs of such facility through rental payments and other means[6]; or is an economic development project, including commercial and residential development and related infrastructure, that (a) incorporates private investment and (b) is physically or functionally related to a passenger rail station or a multimodal station that includes rail service, (c) has a high probability to commence work within 90 days, and (d) has a high probability of reducing Federal funds assistance for the rail station or service by increasing ridership, rental payments or other activities that generate revenue in excess of project costs.

To be eligible a project must have delivered a letter of interest to the Secretary of Transportation (the “Secretary”) and received a determination of eligibility from the Secretary by September 30, 2025. For each fiscal year, qualifying projects will be eligible for up to 15% of TIFIA’s total budget authorization for that fiscal year.

- Airport-related projects – Eligible to be financed by passenger facilities charges by federal law, including airport development and planning, gate construction and the conversion of vehicles and ground support equipment to low emission technology. As with transit-oriented projects, (i) to be eligible the airport project must have delivered a letter of interest to the Secretary and received the Secretary’s determination of eligibility by September 30, 2025 and (ii) this category of projects will have the same yearly 15% share of total TIFIA budget authorization, and

- Habitats – Projects to acquire plant and wildlife habitats pursuant to a transportation project environmental mitigation plan that has been approved by the Secretary of Interior in accordance with the Wildlife Protection Act. This facilitates funding for instance for the purchase or lease of land for conservation areas required to mitigate the environmental impact of transportation projects.

Streamlined application process

In addition, the IIJA requires the Secretary to design, within 120 days after enactment of the IIJA, a streamlined application procedure for certain projects but such easier procedure comes with limitations, including, among other that the project must have (a) a reasonable expectation that the contracting process for the project can commence within 90 days after a Federal credit instrument is obligated for the project under the TIFIA program; (b) the TIFIA senior secured loan have a rating of at least A, (c) the senior secured TIFIA loan does not exceed 33% of total eligible costs, and (d) the project has received a Finding of No Significant Impact under NEPA.

Flexible terms

The IIJA has also softened some of the requirements under the program by, among other things:

a) Extending the period for contingent commitments under a TIFIA master credit agreement from three years to five;

b) Facilitating projects with only one ratings opinion (where previously any project over $75 million required two separate investment grade rating, now the bar for requiring two ratings has been raised to $150 million); and

c) Extending the potential maturity of a TIFIA loan for a capital asset with an estimated useful life of more than 50 years to the lesser of: (i) 75 years after the date of substantial completion and (ii) 75% of the estimated usable life of the asset.

Payment and performance security

Any project making use of the TIFIA program must demonstrate that its design and construction are supported by appropriate payment and performance security, regardless of whether the obligor is a private entity or a State, local authority or any department or instrumentality thereof. If local law requires such security, then the Secretary may accept that security if “the Federal interest with respect to Federal funds and other project risk related to design and construction is adequately protected”.

The IIJA opens the door for the potential use of TIFIA funds to support in part the development of neighborhoods around train stations, including mixed-use real estate projects. TIFIA financing will be available not only to fund the reconstruction or refurbishment of an existing station plus access roads and other related infrastructure, but also commercial and potentially some residential buildings that are physically or functionally related to a station providing passenger rail service[7]. Of course, any sponsor wishing to avail itself of TIFIA’s favorable financing will need to carefully design a revenue structure for the project so that its senior debt can achieve the required rating. This could include availability payments from the city or state (probably for the station and some related infrastructure), public grants, and/or long-term rental commitments by the tenants of the public buildings.

In addition, we do expect the expansion of the Program to result in TIFIA financing becoming a valuable tool for airport projects, given that many US airport installations are considering expanding or refurbishing passenger terminals (including regional and local airports) and cargo terminals.

Conclusion

The expansion of the TIFIA financing program in late 2021 is a positive step towards realizing significant progress in the refurbishment of America’s ailing infrastructure, in expanding the types of projects eligible for low-cost, long-term federal financing for projects (although limiting the expanded projects’ share to 15% of total TIFIA loan availability in any year for each of the transit oriented and airport related project categories), and providing more flexible loan terms, including longer loan commitment periods and potential maturity dates, as well as lowering rating requirements from two to a single credit rating per project. These improvements, when combined with opportunities to combine TIFIA funding with federal and state infrastructure grants, as well as the partial expansion of project types that are eligible to utilize tax-exempt “private activity bonds” in their capital stack, should help private investors leverage federal money to fund vitally needed improvements to US infrastructure on a cost-efficient basis -- at a time when the deterioration of our infrastructure has reached a tipping point.

Now it is up to state and local authorities to tender projects that are well structured so as to be technically viable, to have the potential to utilize these improvements, and are appetizing enough to draw private investors to the procurement table.

Footnotes

[1] In the last 20 years, TIFIA loans have supported the construction of more than 75 large transportation projects.

[2] The Build America Bureau also manages the Railroad Rehabilitation and Improvement Financing (RRIF) credit program.

[3] Pursuant to the Surface Transportation Reauthorization Act of 2021, the Program total for each year starting 2022 through 2026 is $250 billion for a total of $1,250 billion.

[4] The form of TIFIA loan and TIFIA Intercreditor Agreement grant to the TIFIA lender (ultimately, the United States), a ‘springing lien’ whereby such loan becomes pari passu with senior debt upon the occurrence of a bankruptcy event.

[5] 23 U.S.C. § 601(a)(12)(E).

[6] 49 U.S.C. § 5302(3)(G)(v).

[7]Such “public sector activities” include daycare, health care, education, and job training. www.transportation.gov/buildamerica/TOD/faqs

Article originally published in the March 23, 2022 edition of Project Finance International.

Skip to main content

Skip to main content