Financing ESCO Energy Efficiency Projects

The project financing of energy efficiency projects is gaining traction, fueled in part by the embrace by the business community – including lenders – of sustainability policies and the adoption of environmental, social and governance (ESG) standards and goals as both risk reduction and value enhancing tools, including those tied to greenhouse gas (GHG) emissions reduction. Energy efficiency mechanisms run the gamut from establishing policies and incentives to encourage responsible energy use, to investing capital to achieve real reductions in the use of power generally and fossil fuels specifically. This article concentrates on the latter and provides an overview of financing so-called ESCO energy efficiency transactions.

An energy efficiency service company (ESCO) is primarily dedicated to designing, installing and maintaining energy efficiency solutions for commercial customers to reduce energy consumption and GHG emissions at the customer’s properties. Such solutions can include energy efficient retrofits (e.g., insulation, air conditioning and/or lighting), energy use optimization or similar services, as well as the design, construction or installation of more efficient combined heat and power plants, intelligent metering systems, distributed energy via solar, wind or microgrid systems (such installations and equipment, the energy efficiency facility, or EEF). The ESCO’s preferred contract structure is performance-based, where its remuneration is tied to the energy savings achieved by its customer. An ESCO will typically enter into an Energy Services Agreement (also known as an Efficiency Services Agreement, or ESA) with a customer (the Owner) that owns or uses property with significant energy costs (for instance a retail or hotel chain, or a university campus). Under the ESA the ESCO will agree to fund upfront the cost of designing, engineering, procuring and building or installing the necessary EEF and to operate and/or maintain the EEF for an agreed term, in return for remuneration calculated primarily with reference to the actual energy cost savings achieved by the agreed EEF below the customer’s costs before the retrofit. Typically, ESCOs are financial parties that subcontract the actual performance of the work and services to a third-party contractor, known as an energy services performance company (ESPC).[1]

A well-structured ESCO energy efficiency transaction can be project financed on a limited recourse basis. As in any project finance transaction, the lenders will need to be satisfied that, among other things, the members of the basic contractual triangle (ESCO, ESPC and Owner) have a satisfactory credit profile and the ESCO and ESPC have a successful technical track record. Moreover, the contractual arrangements must be enforceable and contain adequate risk mitigation provisions, the technology to be used must be proven, and the amount of equity committed by the stockholders of the ESCO-borrower must be sufficient to make the project financeable as demonstrated by the borrower’s financial model.

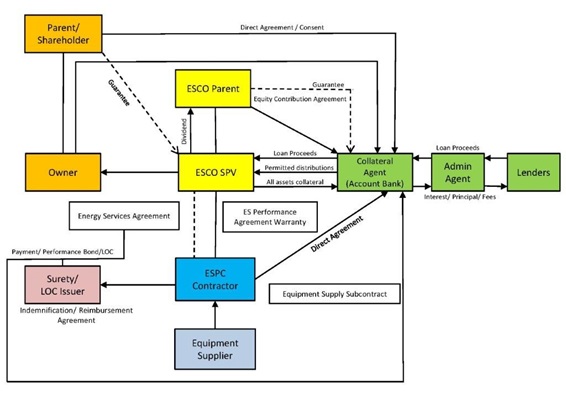

A typical financing structure may look like this:

Lenders will generally accept the ESCO, as ESA counterparty, to be a special purpose entity owned and controlled by the ESCO’s sponsors, subject to acceptable equity contribution agreements or up-front equity-funding requirements. Since lenders will expect to be repaid from the cash flow generated by the ESA, they will expect the ESA to contain a clear, predictable and enforceable structure for remuneration by the Owner as well as monetary protections in case of early termination of the contract.

The parties will also need to agree on who will have title to the EEF and whether the EEF is to remain at the Owner’s property at the end of the contract term, which may be shorter than the useful life of the EEF. Lenders pay close attention to the ownership of the EEF, which affects the type of security interest that the ESCO can grant over the EEF in favor of the lenders, and whether the lenders can foreclose on the EEF in case of default under the ESCO’s loan. In addition, the subcontract between the ESCO and the ESPC needs to provide for a full assumption by the ESPC of all of the ESCO’s performance obligations under the ESA (i.e., a full pass through or “flow down” from Owner to ESCO, and from ESCO down to ESPC).

The security package will typically include a collateral assignment by the ESCO to the lenders (or their collateral agent) of all the ESCO’s assets and contractual rights. This would include in particular the granting of a security interest on the actual EEF to the extent the EEF is to be owned by the ESCO after the commencement of commercial operation of the EEF. If the Owner only has leasehold title to the underlying property, there may be a need to obtain the property owner/landlord acknowledgment and agreement as to the ESCO’s lenders’ rights to exercise their remedies over the EEF collateral in case of an ESCO default under the financing documents. In addition, the lenders will require consents to assignment (or “direct agreements”) from the Owner and the ESPC, respectively, whereby each acknowledges and consents to the assignment by the ESCO of its contracts with them to the lenders (or the Collateral Agent) and recognizes the lenders’ (or the agent’s) right to cure and “step in” and take over the ESCO’s obligations to install and/or maintain the EEF in case of an ESCO default, and to the exercise of other remedies. As in most project financings, the lenders will require as additional security a pledge of all of the ESCO’s bank accounts relating to the project, including generally (a) a construction account where loan proceeds will be escrowed and disbursed during construction (subject to the approval of an independent engineer acting for the lenders); (b) a revenue account, where payments from the Owner will be deposited and funds will be disbursed in accordance with a customary waterfall; (c) debt service and possible other reserve accounts; and (d) an insurance proceeds account. Finally, the ESCO’s shareholders will be required to pledge their equity interests in the special-purpose ESCO.

For its part, the ESPC’s performance (and payment) obligations under the construction and maintenance agreements should be secured by a third-party letter of credit or performance bond from a creditworthy issuer or surety satisfactory to the lenders.

One of the challenges of these financings is that in some cases, the market value of the EEF may not be sufficient to cover the borrower’s debt obligations in case of a default under the financing documents. Thus, the credit quality of the Owner will be a key element of the transaction, which may be enhanced if necessary by some form of Sponsor credit support.

Another challenge to project financing an energy efficiency project is project size. While the limited or non-recourse nature of a project financing is most often appealing, execution costs for a project financing can be considerable, resulting in either limited lender appetite, or limited cost effectiveness for the transaction parties. This can sometimes be solved where a number of energy efficiency projects that are small individually can be bundled together to benefit from a portfolio financing.

Finally, the ESCO may be able to access certain tax incentives in connection with project financing an energy efficiency project. For instance, if the ESCO or an affiliate constructs a qualifying solar project, and either sells electricity to the Owner pursuant to a power purchase agreement or leases the project to the Owner, the ESCO (or affiliate) may be eligible to claim a federal investment tax credit (ITC) and accelerated depreciation on the project.[2] A taxpayer generally may utilize ITCs to offset federal income taxes arising in the year the solar project is placed into service, although, under current law, unused ITCs for a taxable year generally must be carried forward to a subsequent year when the taxpayer has sufficient federal income taxes to be offset by the credit.[3] For this reason, developers of qualifying solar projects often seek co-equity investors, commonly referred to as tax equity investors, that have sufficient federal income tax exposure to utilize the ITCs and accompanying accelerated depreciation on a current basis and, based on the value of these benefits, generally accept an otherwise below-market economic return on their investment. State and local incentives benefitting solar projects also may exist, depending on the particular jurisdiction.

We expect ESCO energy efficiency projects, and therewith their project financings, to grow as companies continue to look for ways to minimize their energy consumption and effectively manage the cost of implementing energy-saving equipment and facilities upgrades, as well as to achieve demonstrable reductions in their GHG emissions.

Footnotes

[1] We note that as part of its Federal Energy Management Program the US Department of Energy has developed a number of energy efficiency structures to encourage federal agencies to continue to reduce their energy use; among those structures, the DOE contemplates an “ESPC ESA” structure (see at: https://www.energy.gov/eere/femp/energy-savings-performance-contract-energy-sales-agreements) that is substantially similar to the one described in this article, but a discussion of the particularities of the federal program is outside of the scope of this article.

[2] The ESCO may be able to access the production tax credit (PTC) (or, in certain cases, a special wind ITC in lieu of the PTC) with respect to qualifying wind projects, although wind assets tend to be incorporated into energy efficiency projects less often than solar assets.

[3] The Biden administration’s fiscal year 2022 revenue proposal would permit a taxpayer to elect a cash payment in lieu of claiming the ITC (the so-called “direct pay option”, similar to the “cash grants” offered in lieu of ITCs following the 2008-2009 financial crisis ), which would make the ITC more desirable to taxpayers without sufficient taxable income to absorb the credit.

Article originally published in the October 6, 2021, edition of Project Finance International.

Skip to main content

Skip to main content